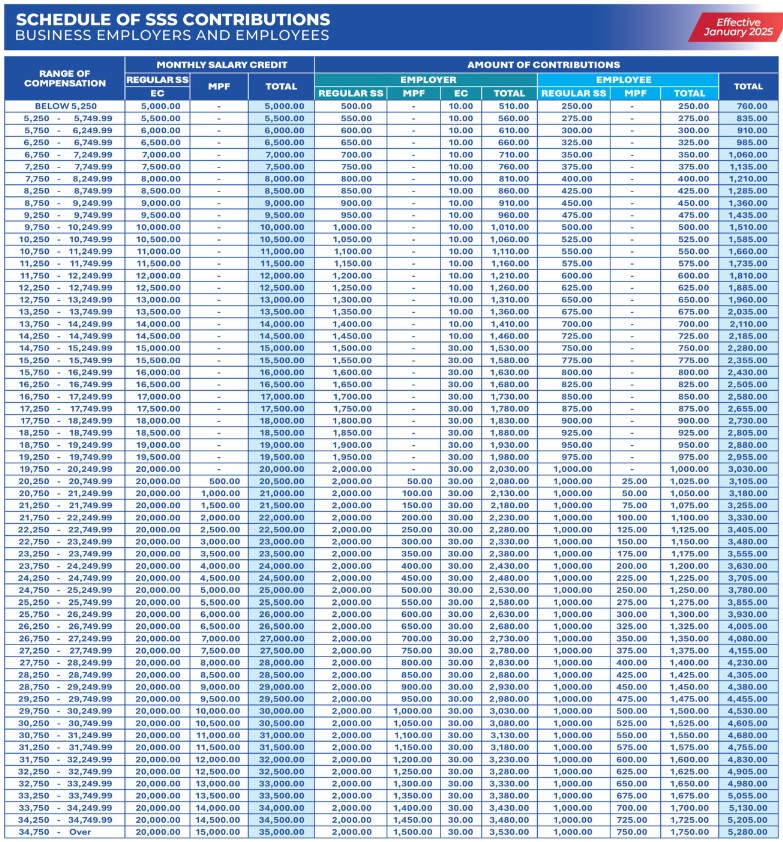

Pursuant to SSS Circular 2024-006, the following changes to the contributions for Business Employers and Employees in accordance with Republic Act No. 11199, otherwise known as the Social Security Act of 2018, shall take effect on January 2025.

The changes are as follows:

- Increase of Contribution Rate to 15%

- Increase of Minimum Salary Credit to Php5,000.00

- Increase of Maximum Salary Credit to Php35,000.00

Source: https://www.sss.gov.ph/wp-content/uploads/2024/12/Cir-2024-006-Employers-scaled.jpg

Here is a sample computation on how to use the table:

- Your monthly salary is Php15,603.75

- Employer Regular SS: Php1,550.00

- Employer MPF: Php0.00

- Employer EC: Php30.00

- Employee Regular SS: Php775.00

- Employee MPF: Php0.00

- Your monthly salary is Php22,812.50

- Employer Regular SS: Php2,000.00

- Employer MPF : Php300.00

- Employer EC: Php30.00

- Employee Regular SS: Php1,000.00

- Employee MPF: Php150.00

- Your monthly salary is Php45,000.00

- Employer Regular SS: Php2,000.00

- Employer MPF : Php1,500.00

- Employer EC: Php30.00

- Employee Regular SS: Php1,000.00

- Employee MPF: Php750.00

The Synergy Human Resource Information System (Synergy HRIS) has been updated with the latest contribution rates. All payroll computations will automatically be using the new rates for the year 2025 onwards.